Understanding Green Credit Cards

Will you choose the original Green Credit Card from American Express, or were you looking for that other green card, the green Visa card from Wise? These are the most sought-after green cards. There’s something for everyone; Amex, Visa, or Mastercard.

- First year FREE

- Shop online safely

- Earn 1 point per euro

- Insured purchases

- Temporary free physical Visa card

- Multiple currency accounts

- Pay as you use

- Online income and expenses

- Most popular

- Plant trees with your spending

- Pay as you use

- Open your account with a phone & ID

Apply for your Green Credit Card now

Green credit cards have gained significant popularity among consumers who seek a balance between affordability and valuable perks. Often positioned as entry-level options, these cards offer essential features designed to cater to a broad audience.

A hallmark of many green cards is their commitment to sustainability, appealing to users who wish to align their financial choices with their environmental values. With various financial institutions launching green card offerings, users can access services that include rewards programs, security features, and basic customer support without incurring high fees.

Affordability and Accessibility

One of the standout features of green credit cards is their low or nonexistent annual fees, making them a budget-friendly choice for many consumers. This aspect makes green cards especially appealing for individuals looking to build their credit history or manage their finances more effectively.

Additionally, these cards often come with rewards programs that allow cardholders to earn points or cashback on everyday purchases. This incentivizes users to utilize the card for routine expenses while enjoying the benefits of a credit card without the burden of high costs.

Environmental Initiatives

A unique selling point of many green credit cards is their focus on sustainability. Several institutions offer programs where a portion of your spending contributes to environmental causes, such as tree planting or supporting renewable energy projects.

This alignment with eco-friendly initiatives attracts consumers who are increasingly mindful of their environmental footprint. By choosing a green credit card, users can feel good about their spending habits, knowing they are contributing to meaningful environmental change with every purchase they make.

Factors to Consider

When evaluating different green credit card options, it’s crucial to consider various factors such as rewards, fees, and additional benefits. Some green cards provide exclusive perks, including access to special events, travel benefits, or enhanced customer support.

These features can significantly impact the overall value of the card based on an individual’s lifestyle and spending patterns. Conducting a thorough evaluation of available options can help consumers find a green credit card that aligns with their financial goals and personal values.

Making the Right Choice

With a wide array of green credit cards available in the market, choosing the most suitable one can be daunting. However, understanding the distinct features and benefits associated with each card can simplify the decision-making process.

Whether you’re interested in the original Green Credit Card from American Express or the green Visa card from Wise, there is likely an option tailored to meet your specific needs. Read on to discover the top green credit cards currently available and find the perfect fit for your financial journey.

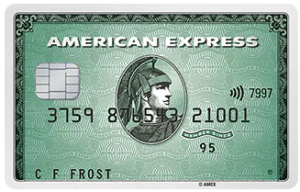

The original Green Credit Card from American Express

The Green American Express Card, also known as the American Express Green Card, was introduced in 1969. It was the first credit card issued by American Express and a pioneer in premium credit cards. The Green Card was designed for a premium customer segment, offering benefits that were fairly new at the time, such as a higher credit limit and a more comprehensive customer service level.

Why American Express?

- Customer service: American Express is known for its excellent customer service and personalized support. Cardholders can often rely on a high level of service and attention.

- Travel and purchase protection: Many American Express cards offer extensive insurance for travel and purchase protection. This can include trip cancellations, medical emergencies, and extended warranties.

- Loyalty programs: American Express has various loyalty programs, such as Membership Rewards, where cardholders can earn points for their purchases. These points can be redeemed for travel and shopping perks, gift cards, and more.

- Access to exclusive events: Cardholders often get access to exclusive events, such as concerts and previews, and special offers at luxury stores and restaurants.

- Security and fraud protection: American Express provides extensive fraud protection and quick responses to suspicious activities to ensure the safety of cardholders.

The American Express Green Card

- Simple rewards structure: The Green Card offers a straightforward rewards system with Membership Rewards points for every euro spent, which can be appealing to those who don’t need complex reward structures.

- Travel benefits: The Green Card provides certain travel perks, such as access to a wide range of travel-related services and discounts, though these benefits are generally less extensive than those of the higher-tier American Express cards, like the Gold or Platinum Card.

- No foreign transaction fees: The Green Card charges no additional fees for transactions abroad, making it convenient for international travelers.

- Flexible payment options: The Green Card offers flexible payment options, allowing cardholders to manage their expenses in a way that suits their financial situation.

- Access to services: The card may grant access to additional services and benefits, such as concierge services and special offers from selected partners.

In summary, the American Express Green Card provides a solid package of benefits, especially for those who want to experience the perks of a premium credit card without the higher costs that sometimes come with more exclusive cards.