Understanding Gold Credit Cards

Comparing and Applying for Gold Credit Cards

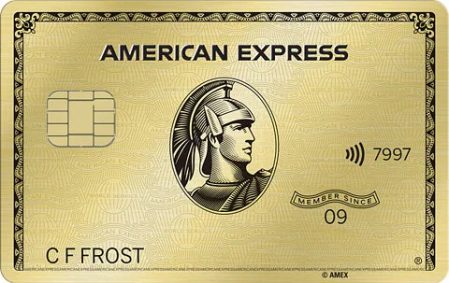

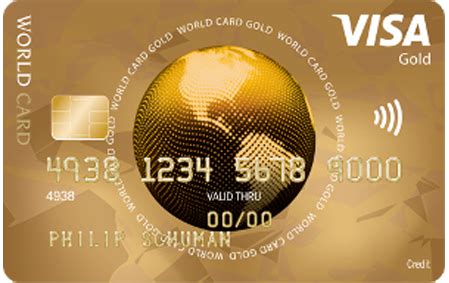

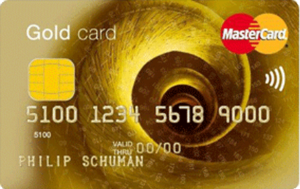

Gold Credit Cards are among the most exclusive credit cards, offering significantly more benefits compared to a Silver Credit Card. Explore the exclusive gold cards from American Express, Mastercard, and Visa, and choose your card.

Gold Credit Cards are designed for individuals who seek enhanced rewards and benefits compared to standard cards. With a Gold Card, you can enjoy perks that make everyday spending more rewarding. You will earn points or miles for your purchases, which can be redeemed for travel, shopping, or other exclusive offers. This added value is a significant reason many people choose Gold Cards over their basic counterparts.

Travel Benefits

One of the most attractive features of a Gold Credit Card is the array of travel-related benefits. If you frequently travel, having a Gold Card can provide you with access to airport lounges, travel insurance, and even priority boarding on flights. These perks can make your journeys smoother and more enjoyable, enhancing your travel experience significantly. This card can be a game-changer for anyone who spends considerable time away from home.

Purchase Protection

Gold Credit Cards often come with additional purchase protection benefits. This means that when you shop, your purchases may be covered against theft or damage for a certain period after the purchase. This peace of mind can be invaluable, allowing you to shop confidently without worrying about the security of your new items. The extended warranty on electronics or other high-value items is also a common benefit, adding more value to your card.

Personalized Customer Service

In addition to travel and purchase protection benefits, Gold Credit Cards frequently offer personalized customer service. Many card issuers provide dedicated support for Gold Cardholders, ensuring that your queries and issues are addressed quickly and efficiently. This level of service can be especially important during travel emergencies or when you need assistance with card-related issues.

Weighing the Costs and Benefits

Ultimately, choosing a Gold Credit Card is about weighing the benefits against the costs. While these cards typically come with an annual fee, the value you receive in rewards, travel perks, and enhanced customer service often outweighs the expense. If you are a frequent traveler or someone who wants to maximize rewards from everyday spending, a Gold Card could be a wise investment.

Why Choose Just One? Get Three Cards for Safety

You could spend endless time comparing gold cards, but why bother? Each card issuer has a different network of ATMs, and acceptance in stores can vary. Don’t take any chances—make sure you always have an American Express, a Visa card, and a Mastercard with you while on vacation. This way, not only will you have a valid payment method, but you can also choose which card to use for earning points.

American Express is especially known for its convenience when traveling by air and for earning points with tickets and daily expenses. The purchase insurance offered by a Visa Gold card makes it an attractive choice for online shopping, and it’s always a good idea to have a Mastercard for backup in case the Visa network is unavailable.

Conclusion

Comparing and applying for Gold Credit Cards can help you find the best option tailored to your needs. Gold Credit Cards stand out as some of the most exclusive options available, providing significantly more benefits than Silver Credit Cards.

Explore the various exclusive Gold Cards from American Express, Mastercard, and Visa to discover which card aligns best with your financial goals. With options like the American Express Metal Gold Card, Visa World Card Gold, and KLM Gold Card, you can access a range of perks that enhance your spending experience and travel convenience.